The month to month drop is the principal positive perusing on expansion since the pandemic and battle in Ukraine drove costs higher.

Expansion directed in April, as the buyer cost file expanded 0.3% following a 1.2% increment in March, the Bureau of Labor Statistics provided details regarding Wednesday.

A 6.1% drop in the cost of energy was the main supporter of the downfall, in spite of the fact that costs diminished for utilized vehicles, attire and correspondences.

The downshift brings the annualized rate down to 8.3% from 8.5% and is the primary sign that the out of control expansion brought about by the Covid pandemic and Russia’s February intrusion of Ukraine might be ebbing somewhat.

Barring food and energy, costs expanded 0.6% in April contrasted with 0.3% in March.

“Alongside lists for cover, aircraft charges, and new vehicles, the records

for clinical consideration, diversion, and family goods and activities generally expanded in April,” the report said.

Expansion is the No. 1 issue refered to by Americans in reviews and is the top focal point of the Federal Reserve. Last week, the Fed raised loan costs by 50 premise focuses and flagged more climbs to come consistently.

The national bank is attempting to design a “delicate arriving” for the economy where development eases back, expansion starts to retreat from 40-year highs, yet the nation gets away from a downturn.

As of now, there are signs that a portion of the classifications that have seen the steepest expansions in costs during the pandemic, like pre-owned cars, are dropping in cost. A report let Wednesday morning out of Adobe Analytics found that web-based costs sneaked through April interestingly starting from the beginning of the pandemic.

A few onlookers accept the 8.5% rate that expansion hit in March could address the high-water mark for expansion in the momentum monetary cycle. However, others fret that expansion is more inescapable than the Fed says.

“We’ve been in the pinnacle expansion camp for some time presently,” says Brent Schutte, boss speculation planner at Northwestern Mutual Wealth Management. “It starts turning over hard in the following couple of months.”

Schutte says the vital readings to watch are the numbers for “center” expansion, costs barring frequently unpredictable food and energy, as that is more intelligent of hidden cost pressures and less helpless to shocks like the pandemic and international strains.

“Deeply,” he says. “They truly can’t do much about food and energy.”

The phantom of expansion and vulnerability over the conflict and proceeded with COVID-19 impacts in China have shaken worldwide business sectors lately, with U.S. markets experiencing their most horrendously awful stretch beginning around 2000. In any case, Wednesday, in front of the report, Dow Jones Industrial Average fates were up north of 300 places and yields on the 10-year Treasury plunged underneath 3%.

Also, a new study by the New York Federal Reserve Bank observed that shoppers were turning into somewhat more hopeful about expansion last month. Assumptions for cost increments over the course of the following a year tumbled to a middle 6.3%, a 0.3 rate point decline from March’s record high.

Customers keep on spending, nonetheless, having amassed investment funds during the pandemic.

“The extraordinary vulnerability of the economy is a substantially more huge variable in compelling customer spending than purchasers’ ability to spend,” says Jonathan Silver, CEO of Affinity Solutions, which tracks charge and Visa spending. “Coronavirus spikes, unpredictability in the financial exchange and the conflict in Ukraine have shaken individuals’ feeling of strength, yet that doesn’t mean there’s an absence of assets or readiness to spend from here on out.”

Fondness as of late directed an examination of ways of managing money dispatched by GSTV, which is an organization that gives recordings to corner stores, and found that significantly higher gas costs don’t crease spending.

“As costs rise, our exploration with Affinity Solutions features a classification of shopping trips for which shopper spending development has far surpassed expansion – standard, week by week stock-ups on food and different fundamentals that frequently happen in the wake of powering up,” says Eric Z. Sherman, leader VP for bits of knowledge and examination at GSTV.

“We’ve seen proof that this development is connected with a change in shopping conduct that grabbed hold during COVID – less excursions, yet bigger bushel sizes,” Sherman adds. “These are likewise the sorts of center family shopping trips for non-optional things that might show less cost versatility.”

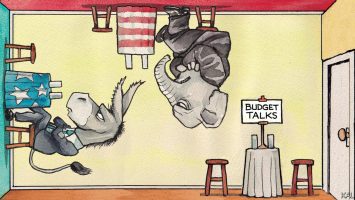

Expansion isn’t just a financial issue yet a political one as Congress and the White House head toward the urgent November midterm races. President Joe Biden has lately tried to depict Republicans as rivals to his endeavors to manage expansion.

“I believe each American should realize that I am approaching expansion exceptionally in a serious way and it’s my top homegrown need,” Biden expressed Tuesday with an end goal to stretch out beyond the report.

In any case, regardless of moves to further develop store network bottlenecks, stem rising gas costs and put resources into efficiency upgrading measures, there is minimal that government officials in Washington can do to influence the conflict in Ukraine or the spread of the Covid, the two essential specialists of the ongoing expansion.

“Congress and the White House can change the drawn out direction of expansion by improving the useful limit of the U.S. economy through interests in human and actual capital, yet they miss the mark on devices to control expansion from one month to another,” Morning Consult Chief Economist John Leer said Wednesday morning in front of the shopper cost record report.

“I value the political difficulties that expansion stances to the White House, yet I don’t believe there’s a ton that they can do on this issue throughout the following couple of months,” Leer added.

Leave a Reply